Tax Provision

Spreadsheets are the tool

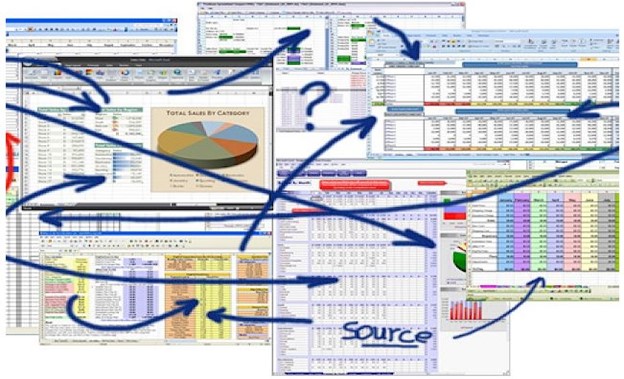

Spreadsheets are the tool of choice amongst tax practitioners, yet they are inherently prone to errors, typically require replication of financial data, and are usually maintained independent from other applications. They are not the most efficient tool so it is hard to meet financial close deadlines. As a two dimensional model, they simply can’t provide the insight and transparency in tax planning & reporting. Don’t get me wrong, spreadsheets are great tools – just not the best for a sophisticated tax provisioning application.

They ideal tax provisioning solution eliminates data duplication, minimizes manual calculations, and provides multi-dimensional insight into tax data. Tax provision solutions should be aligned with the financial consolidation process and data to increase the efficiency of the process, eliminate data redundancy, and improve insight through multi-dimensional reporting tools. OneStream’s Corporate Performance Management platform does just that – data is loaded once into OneStream and used for both the financial consolidation and reporting process, and also the Tax Provision process. Users can then use the same reporting tools they have for financial reporting to analyze tax data. This platform really does deliver the promise of one version of the truth – this makes the CFO comfortable knowing that everyone is using the same data.

Additional benefits include:

- Standard workflow and approval procedures

- Reduced closing cycle time

- Improved accuracy

- Increased trust in the results.

Tax Provision

Challenges with Spreadsheet Tax Provision Templates

Tax Practitioners may strive for a high-performing tax department…

How to Reduce Risk, Improve Transparency and Increase Efficiency in Tax Provisioning

CFO’s and audit committees are seeking innovation …

USA

USA Saudi Arabia

Saudi Arabia UAE

UAE India

India Pakistan

Pakistan Australia

Australia New Zealand

New Zealand Bangladesh

Bangladesh Malaysia

Malaysia Philippines

Philippines  Georgia

Georgia  Nigeria

Nigeria  Egypt

Egypt