Financial Consolidation

Faster closing times,

Faster closing times, tighter controls and auditability, real-time consolidation, elimination of manual error-prone tasks, and more time for data analysis.

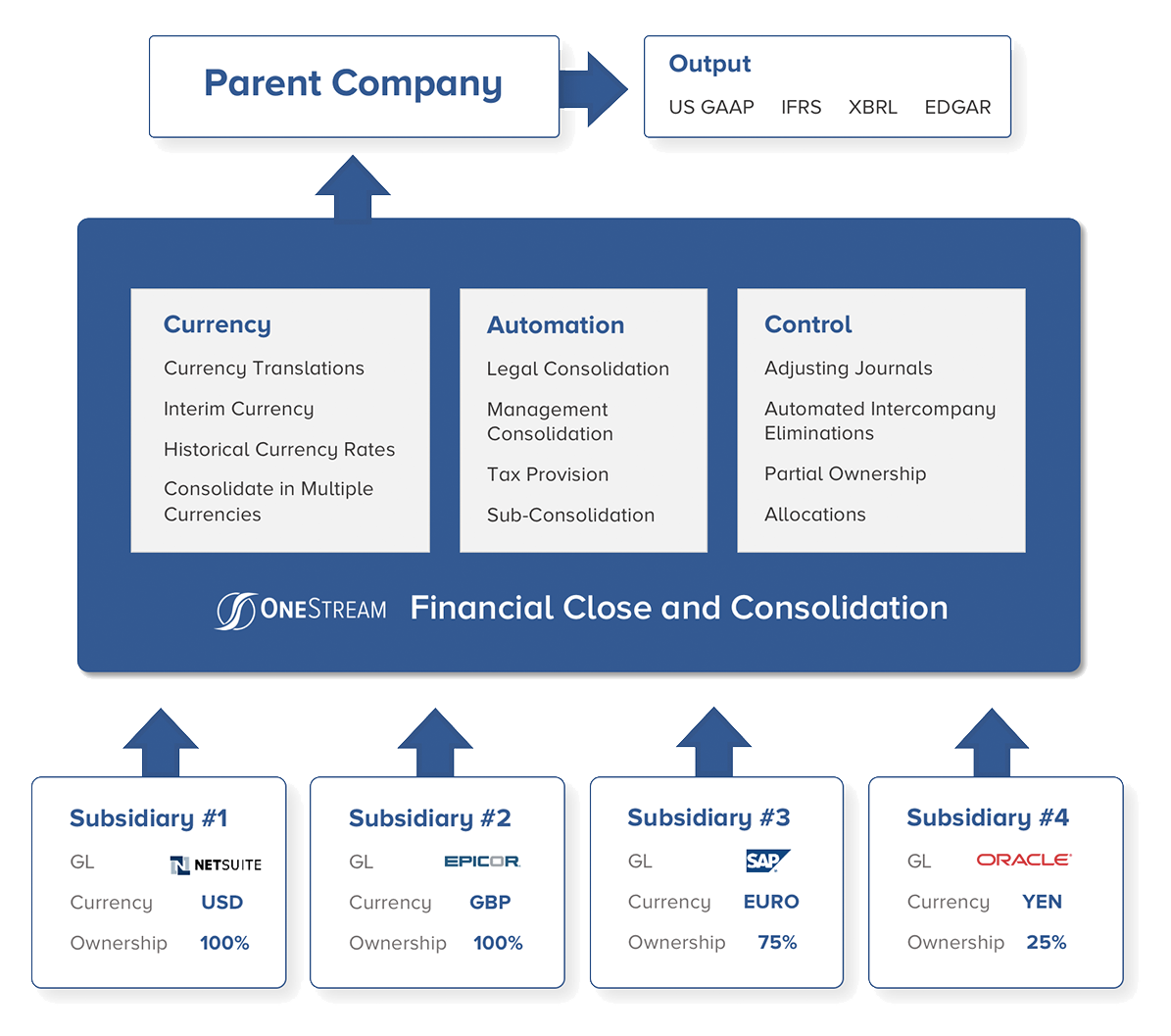

Deliver a fast, accurate financial consolidation – and liberate your finance team to focus on strategy and analysis. We leverage best of breed technologies to help your Finance Team navigate multiple currencies, mergers and acquisitions, and evolving accounting standards and regulations – such as IFRS and local GAAP.

We can help you meet legal and management consolidation and reporting requirements or shave weeks off consolidation processes and help ensure compliance. Generate clear, transparent financial statements and reports relating to profit and loss, cash flows, and balance sheets. Compare budget-to-actual data for assets, liabilities, revenues, and expenses. Automate the inter-company elimination process. Gain transparency into corporate transactions. Manage multiple currencies with conversions, allocations, and eliminations. Perform daily consolidation tasks, and identify which entities to consolidate at what percentages, saving time and reducing errors.

We can help you meet legal and management consolidation and reporting requirements or shave weeks off consolidation processes and help ensure compliance.

Disclosure Management

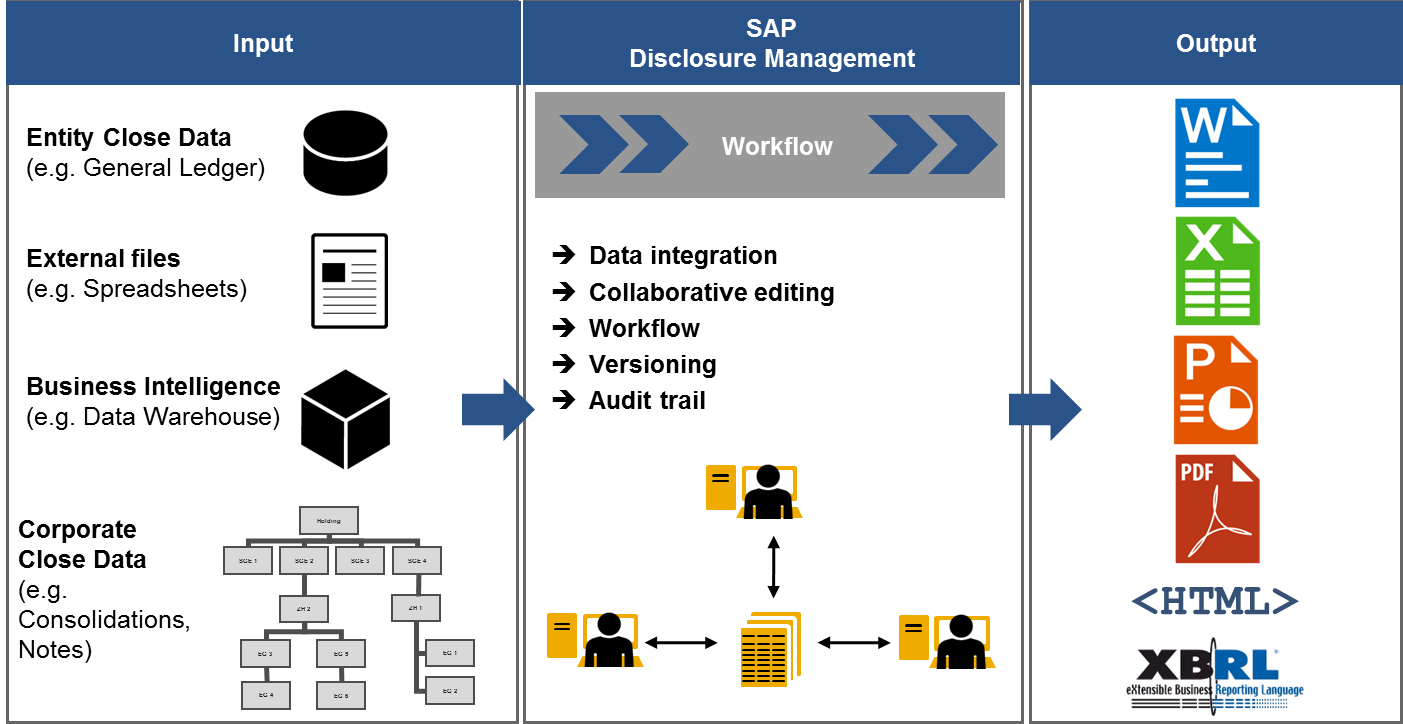

Disclosure Management applications automate and streamline a broad range of currently pervasive manual processes and controls, thus allowing reporting professionals more time to focus on analyzing and communicating corporate performance. They provide increased efficiencies and reduced cost by rapidly collecting and managing enterprise wide data and automating and reusing financial statement components to support regulatory disclosures.

Finally, the owning (i.e. Finance) department can own the Disclosure Management process to streamline collection, validation, workflow, and approval steps.

USA

USA UK

UK Saudi Arabia

Saudi Arabia UAE

UAE India

India Pakistan

Pakistan Australia

Australia Bangladesh

Bangladesh Malaysia

Malaysia Philippines

Philippines  Georgia

Georgia  Nigeria

Nigeria  Egypt

Egypt