Mergers and Acquisitions

M&A deals help you pivot fast, but it's unchartered territory. We can help you stay on course to drive strategic value from your pursuits.

COVID-19: WHAT TO DO NOW, WHAT TO DO NEXT

Creating resilience in uncertain times.Move your M&A with speed and certainty

Digital is rapidly changing how companies operate, adopt tech and manage risk. Organizations must have the right leadership and digital tools to seize and analyze meaningful data that optimizes process and operations, enables enterprise innovation, and unlocks new value in a disruptive world.

Who better to decode the new than the company’s Chief Financial Officer—increasingly the key executive approving the investments required to transform the organization to where it needs to be in the future?

Mergers & Acquisitions

NGOs: M&A for innovation and impact

The speed and scale mergers and acquisitions (M&A) provide are crucial―allowing NGOs to create more holistic change, faster than ever before.

Capabilities

Our cross-functional background enables us to jump in at any point in the process to see your initiative through, from research to onboarding.

Corporate strategy

Get the right strategic fit. We help you make better decisions on why, where and when to invest to align with business objectives.

Learn more.

Target screening

Source the right deal. We'll assess potential and key business drivers to help you prioritize candidates.

Learn more.

Due diligence

Challenge assumptions. Our market, customer, competitor and technology insights help you conduct thorough diligence to choose the right target.

Learn more.

Merger integration

Deliver on the synergies. We'll help you reap the benefits of your deal with confidence.

Learn more.

Divestitures and carve-outs

Let go to grow. We'll build a strategy to help you achieve your divestiture objectives.

Learn more.

Analytics

Get actionable insights. We use advanced analytics to drive performance, expedite the M&A deal cycle and improve decision making.

Learn more.

How we work

Value capture

Focusing on large-scale transformation, we know where to look across the investment cycle for additional value.

Functional expertise

Our dedicated practice carries in-depth knowledge of strategy, supply chain, IT, sales, marketing, finance and change management.

Global reach

Our global network enables us to draw upon the best talent and resources for every project.

What we think

Merging M&A and cloud journeys

Kenz report discusses the benefits of merging cloud and merger & acquisition journeys.

M&A: Does your talent approach fit your deal?

Learn how organization design and talent strategy should vary to maximize M&A; value.

Sweetening the deal: Digitizing M&A

Digital technologies increase M&A deal speed, as well as foster new M&A-related business models previously not possible.

Kenz INTELLIGENT ORGANIZATION ACCELERATOR

Mergers & Acquisitions blogs

Kenz Strategy

Culture in M&A: A source of opportunity

Kenz Katherine LaVelle explains how critical culture is to the future combined company.

High Tech Perspectives

The chip shortage & re-thinking joint ventures

Kenz discusses the onset of COVID-19 that forced automakers to shut down factories across the globe and semiconductor is facing chip shortages.

Kenz Energy

Energy portfolio restructuring: Charting the future

Kenz shares 3 key value levers for a low-carbon future as the energy transition requires all oil and gas companies to rethink their portfolios.

CASE STUDIES

Mergers & Acquisitions

Carve out for competitive agility

To focus on high-growth market segments in the semiconductor sector, NXP needed to divest a leg of business.

Mergers & Acquisitions

Divesting with focus

A life sciences company wanted to sell business that had a foothold in 24 countries. We made it happen.

USA

USA UK

UK Saudi Arabia

Saudi Arabia UAE

UAE India

India Pakistan

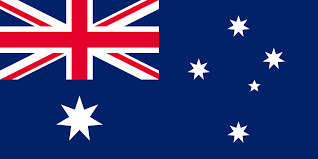

Pakistan Australia

Australia New Zealand

New Zealand Bangladesh

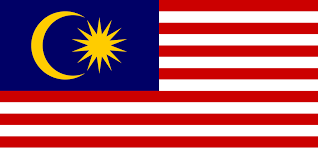

Bangladesh Malaysia

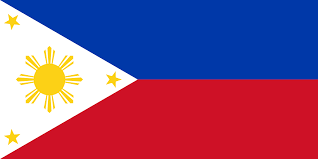

Malaysia Philippines

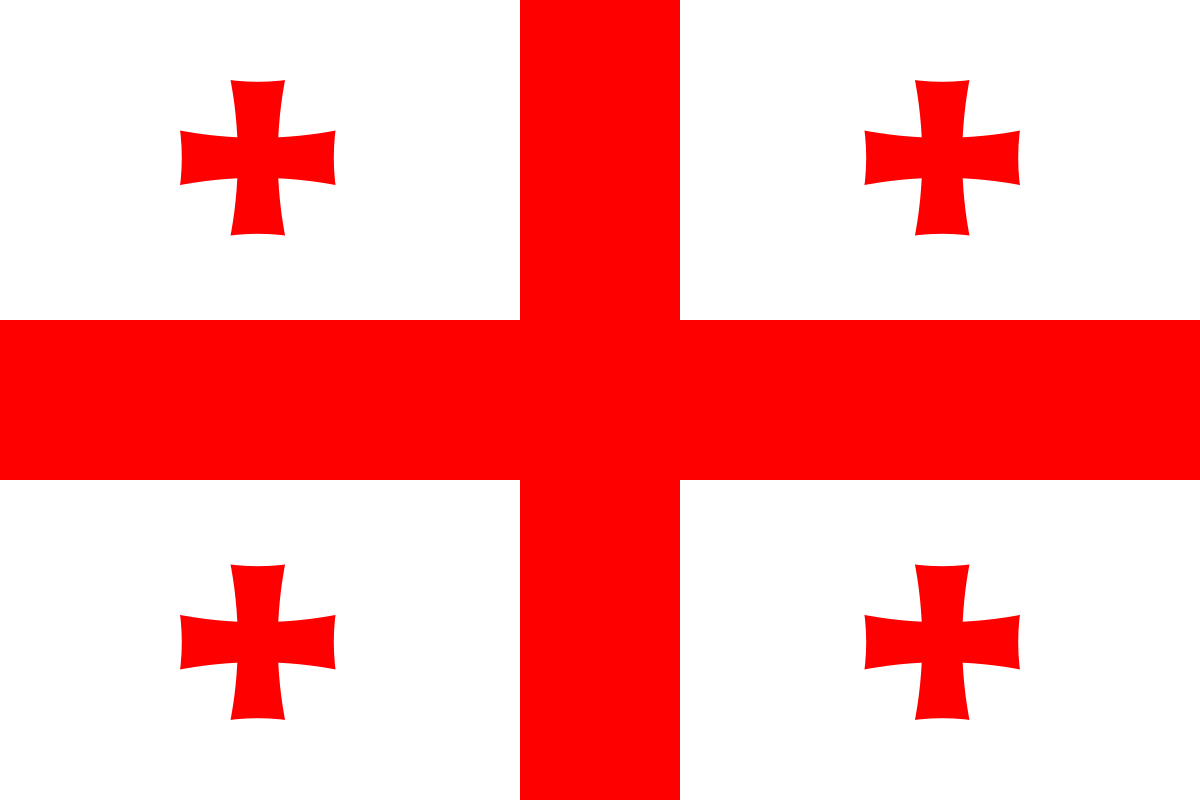

Philippines  Georgia

Georgia  Egypt

Egypt